One of the main attractions of VDS is its ability to convene international agents from the innovation and technology sectors. The latest edition, held in October 2023, brought together more than 600 investors managing assets worth over 30 billion euros and more than 2,200 participating startups aiming to secure 50 million euros in investment.

Some of them took part in panels and lectures, breaking down concepts, analyses, and forecasts, leaving us with some valuable advice for startups and entrepreneurs.

Have Vision

If there’s one thing the investment fund representatives we met at VDS2023 agree on, it’s the importance of an entrepreneur having vision. That means not only having a clear understanding of the current state of their startup but also visualizing the future of their company and where they want it to be in the coming years.

This involves an exhaustive knowledge of the startup itself, knowing its strengths as well as its weaknesses, and understanding how to enhance the former and rectify the latter. As Nico Goulet, Managing Partner at Adara Ventures, explained, “creating a great company isn’t about creating a company that wants to change the world; it’s about creating a company that will have a value of 100 or 200 million euros.” Marta Cruz, co-founder and General Partner at NXTP Ventures, expressed a similar sentiment, noting that “when it comes to investing in a startup, the most important thing is the team, their knowledge, their eagerness to grow, and not so much the investment round they are in.” In the same vein, François Derbaix, co-founder and co-CEO at Indexa Capital, added that entrepreneurs should “ignore short-term fluctuations and the pressure from all the market noise, always keeping a long-term vision.”

Cultivate Your Contacts

For Giuseppe Donvito, Partner at P101, the ideal way to get in touch with a VC is through an intermediary. “Don’t send a cold email; the best option is to find someone who knows the fund, which will give you an extra boost when scheduling a meeting.” This was pointed out during the panel organized by GoHub Ventures and moderated by Pablo Perea, Head of Investments at the fund.

Jonathan Hollis, Managing partner at Mountside Ventures, told us that “VCs are increasingly looking for more regular contact with the companies and entrepreneurs they invest in, whether it’s monthly, and often even weekly.”

Know Your Counterpart

Not all funds invest in all types of startups, and many have patterns or preferences when it comes to adding a new company to their portfolio. Therefore, it’s important to conduct prior research to understand what investments the VC has made recently and to see if your startup fits into that portfolio. For Donvito, for the deal to work, both parties (startup and VC) need to be aligned. “If we don’t invest in a startup, it doesn’t mean it will fail; it’s simply because we’re not aligned.”

Linn-Cecilie Linnemann, CEO at Katapult Group, confirmed that “it’s very important for the startup looking to be invested in to know in which sectors the fund they’re interested in is currently investing; in our case, we’re focusing a lot on the food sector.”

Prepare for the Meeting

They were also unanimous about the importance of making a good first impression and coming to the meeting well-prepared to convey at a glance why they should invest in your company. As Samuel Gil, Managing Partner at JME Ventures, said, “when I go to a meeting with an entrepreneur, I know within about 10 minutes whether I want to invest in their company or not.”

Talk About Your Company

Investment funds invest money in a company, beyond just a product. While the solutions developed are important, the decision to add a startup to a portfolio is based on interest in the company itself. Therefore, it’s crucial to prioritize talking about the startup and not so much about what it sells or who founded it.

As Patricia Pastor, founder and GP at Next Tier Ventures, commented, “an investor in a startup is looking for profitability, something that is a ‘game changer’ and that the company they’ve invested in has a transformative effect.”

One of the forums that generated the most interest at VDS2023, both for the potential of the sector and the level of the speakers, was the aerospace one. During the “Investing in Space Tech” talk, Pedro Duque and Francho García, shared some insights into investing in this sector.

Astronaut and associate professor at the Polytechnic University of Madrid, Pedro Duque, pointed out that in Spain, it’s a good time to invest in space tech “as more and more companies are dedicating their efforts to the space race.”

Francho García, CEO of Arkadia Space, mentioned that private investment is very important “even though there has been a significant increase in public investment in recent years, which greatly benefits the sector.” He explained that the public sector is much more aware of the importance and value of space technology “while the private sector needs more education and evangelization about why this sector is so important.”

The investors participating in VDS2023 shared valuable advice for startups, emphasizing the importance of having a clear vision, a deep understanding of the project, and the significance of a strong and motivated team. They highlighted the need to cultivate strategic connections, prepare meticulously for meetings with investors, and effectively communicate the value of the company beyond the product.

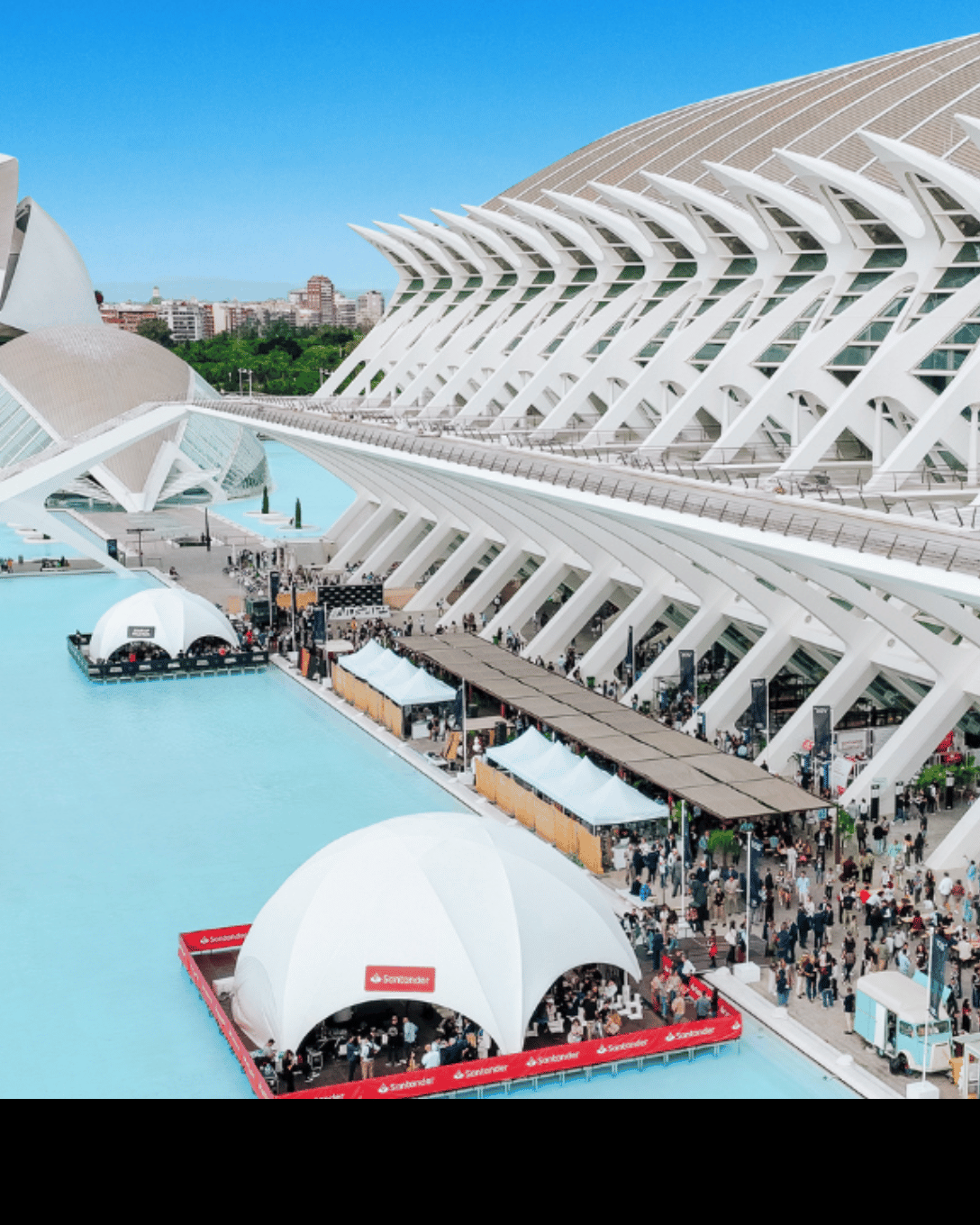

The seventh edition of the international technology event VDS, set to take place on the 23rd and 24th of October in the City of Arts and Sciences in Valencia, will feature over 12,000 attendees from 100 different countries, more than 700 investors, and over 2,500 startups. Additionally, more than 600 renowned international speakers will participate, including a significant percentage of VCs who will offer top advice for any entrepreneur looking to develop in the world of technological innovation and capture the attention of global investors.