At the beginning of the year, stock markets frequently experience what is known as the ‘January Effect,’ a phenomenon where stock prices rise due to a surge of capital into the markets. Although it’s not a guaranteed trend, it is a historically recurring event influenced by what’s termed ‘investor sentiment’ a renewed optimism for the new year.

If we apply the so-called ‘January Effect’ from the stock exchange to entrepreneurship, the Valencian startup ecosystem has kicked off 2024 with the same renewed motivation typical of this stock market phenomenon. In just the first month of the year, Valencian startups secured over 20 million euros in investments, largely thanks to funding rounds by Bit2Me (14 million euros, continued by BBVA Spark), Internxt (3 million euros), and Depasify (2.2 million euros). This vibrant start continued throughout the first quarter, as evidenced by the recent 3 million euro round announced by Imperia, and it persists into the second quarter with transactions such as Hancom’s entry into the Alicante-based Facephi with a 5 million euro capitalizable loan.

Additional recent investments include the Lego Foundation’s 2.2 million euros in the Valencian platform Kokoro Kids; the relocation of the headquarters to Valencia by the Basque-origin startup Vidext, which announced a 2 million euro round with participation from the Valencian fund Draper B1; and the completion of Renfe’s entry into Visualfy with a 1 million euro round.

To put this in context, in the first half of 2023, Valencian startups attracted 30 million euros in investment. In just three months of 2024, they are on the verge of matching this record. If this trend continues, projections could surpass the historical high of 81 million euros from 2022. Undoubtedly, investor sentiment is at a peak in this part of the Mediterranean.

Why are Valencian startups projecting investment records?

Indeed, especially when discussing investment rounds, one should not celebrate too soon until the money is in the bank account. However, looking at the bigger picture, a change in trend was already hinted at the end of 2023 with the V2C round (4 million euros), which has now been confirmed with strong first-quarter data.

With a macroeconomic landscape that is starting to clear, the projection of a possible record investment in the Valencian startup ecosystem is not unfounded. Inflation continues to fall, markets anticipate imminent interest rate cuts, and funds keep arming themselves with capital and seeking out profitable companies with solid growth.

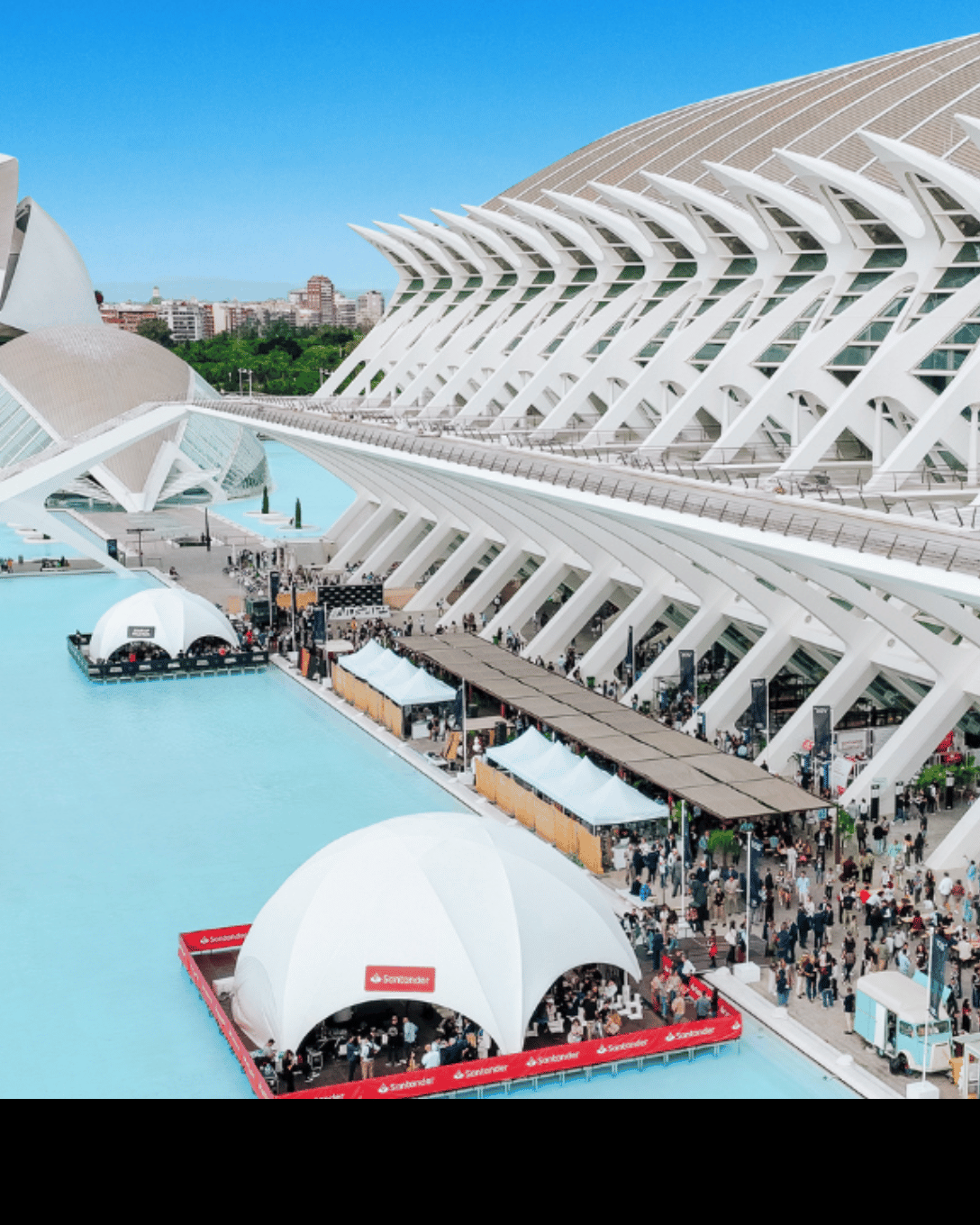

In this context, scale-ups and established ecosystems with an international brand are preferred hunting grounds for investors. And Valencia certainly has this identity. For example, company creation in the Valencia region grew by 11.4% in 2023 compared to the previous year, three points above the Spanish average; the impact of the VDS reached 12.3 million euros and set records again with the attendance of 12,000 professionals from 91 countries, more than 600 national and international investors, and over 2,200 startups.

This tailwind, barring unforeseen events, could propel the Valencian startup ecosystem to a record-breaking year.

The five Valencian startups leading investment in 2024

Bit2Me (14 million euros), Internxt (3 million euros), Imperia (3 million euros), Depasify (2.2 million euros), and Kokoro Kids (2.2 million euros) headline the major investment rounds of Valencian startups this year. Not to forget Vidext, which moved its headquarters from Bilbao to Valencia and also recently announced a 2 million euro round.

The impressive moment some well-known cryptocurrencies are experiencing, such as Bitcoin surpassing 60,000 euros in value (a historical high), is undoubtedly great news for Bit2Me. However, this Valencian company is more than just a leading platform for trading crypto assets; it also specializes in developing Web3 and DeFi solutions.

Much of the credit for this specialization goes to its CIO, David Ortega, founder of the Valencian software factory Dekalabs, which Bit2Me acquired in 2022. Ortega mentioned in an interview a year ago that “central banks themselves are exploring having their digital currency, a clear indication that crypto assets are here to stay.” Initiatives like the ‘Digital Euro’ prove him right, as does the entry of BBVA Spark into the shareholder group.

The fintech’s Head of Innovation explained in the interview that the company’s roadmap is “to continue growing as more users get educated and drawn into the ‘crypto’ world,” and for that purpose, “we are creating a series of products to enable anyone interested to learn and take their first steps in this sector.”

This tech company specializes in storage solutions with data privacy as the core of its value proposition and has had one of the most remarkable journeys in the Valencian entrepreneurial ecosystem. Its revenue has grown from 400,000 euros in 2021 to over three million in 2023.

With a gross margin of 80%, the company has repurchased the stake of The Venture City, one of its investors, thus maintaining 75% of the shares in the hands of its founder, Fran Villalba, as he recently explained.

“This is already the second transaction in the company’s brief history where liquidity is provided to partners either with our own funds or by other partners in the company with the goal of improving their position within the company. The average return given to date is around 300%,” Villalba stated in the interview.

The 3 million euro investment round announced in January saw participation from a variety of funds, including Juan Roig (Angels Capital), Telefónica, Extension Fund, Kevlar Fund, Balaji Srinivasan (a16z, Coinbase), Crowdcube, Banco Santander, and Notion Capital, among others.

Optimizing the supply chain is a major headache for numerous industries, especially since the onset of the war in Ukraine, which has skyrocketed inflation to very high levels, increasing the cost of energy, food, and consumer goods.

Improving production and distribution processes is key for companies to be more competitive, either by enhancing their margins or by making more affordable products (without sacrificing quality) available to consumers.

Imperia is the SaaS that facilitates the planning of demand, production, and purchases, among other aspects. Companies using this software ‘made in Valencia’ have optimized their service level, as revealed by a study conducted by the company among its clients. Out of every 100 orders served, 99.2 are delivered on time and correctly, an improvement of 8.2 points thanks to Imperia.

The recently announced three-million-euro round was led by Samaipata and included participation from All Iron Ventures and Accel Starter Programme, as well as follow-up investments from previous investors such as the Valencians Draper B1 and Angels Capital. Notable ‘business angels’ such as Hugo Arévalo, Jonathan Benhamou, Xavier Pladellorens, Christian Stiebner, Kintxo Cortés, and Maex Ament also joined.

Founded by Alberto Martín, this fintech helps financial institutions digitize in the complex Web3 and digital assets environment, opening new business avenues for these institutions.

“At Depasify, we handle the boring but essential part of digital assets. Financial institutions navigate the best way possible through the triangle of digitalization, risk, and speed to market. Our proposal helps to take a step forward in gaining capabilities without having to rebuild the entire house,” explained its CEO and founder in an interview at the beginning of the year.

The Valencia-based GoHub Ventures, a leader in B2B software startup investment, is one of the main investors in this round, which also includes participation from JME Ventures, Wayra (Telefónica), Actyus, and Lanai Capital Partners.

What better endorsement can there be than an investment from a multinational like Lego in your startup?

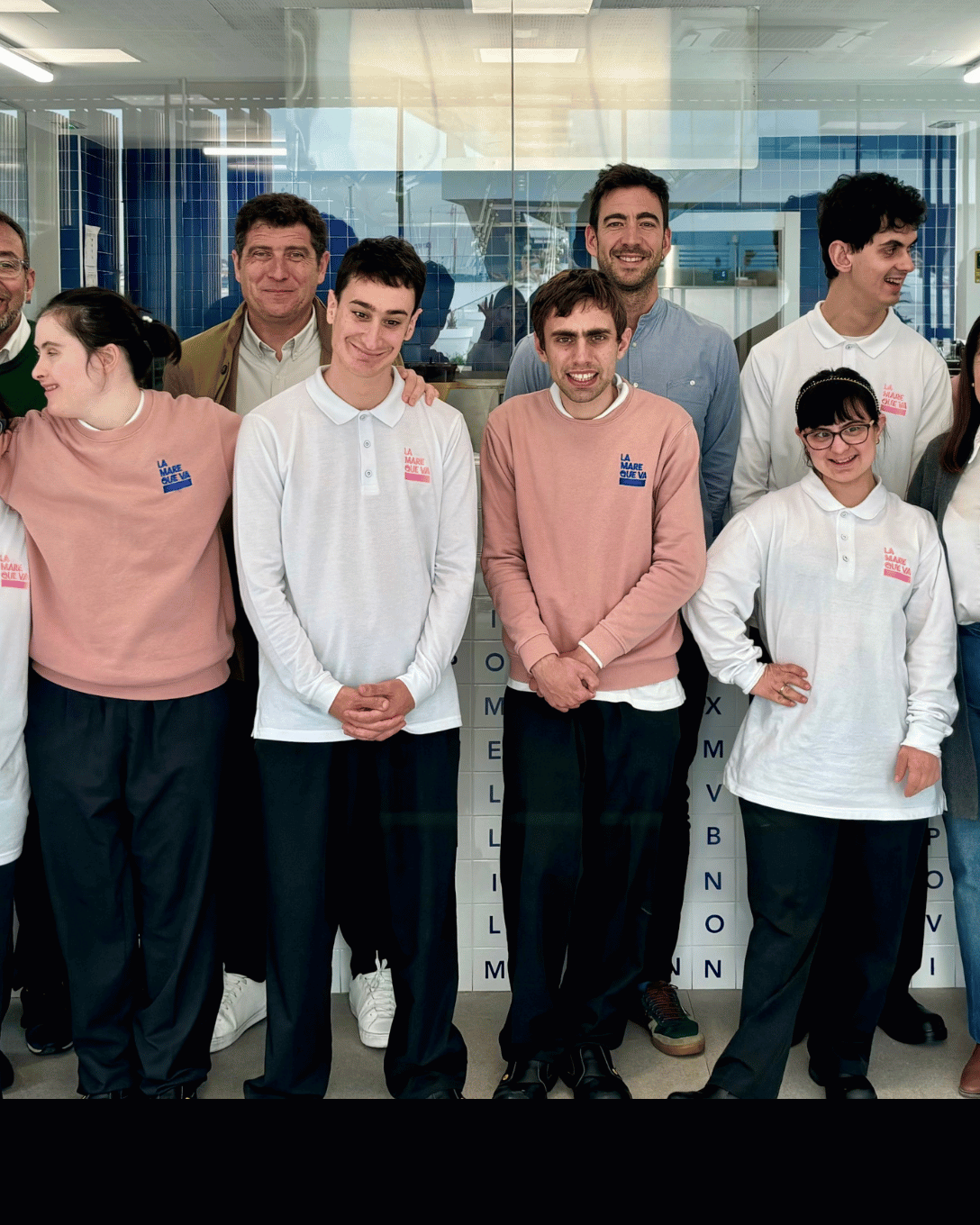

The Valencian educational platform focuses on inclusive online teaching for children and young people aged 2 to 15 years, paying special attention to children with special needs such as Autism Spectrum Disorder (ASD) and Attention Deficit Hyperactivity Disorder (ADHD). It has received backing from the Lego Foundation with an investment of 2.2 million euros.

Among its founders, Carles Pons stands out, who was already a pioneer in the Valencian entrepreneurial ecosystem with the sale of Akamon to the Canadian group Imperus Technologies for 23.7 million euros.

In conclusion, the Valencian startup ecosystem has not only started the year strongly but is also setting an impressive precedent for the future. The numbers we are seeing reflect the strength and dynamism of this innovative and technological hub, which continues to capture the attention and trust of global investors. With each financing round, Valencia not only consolidates its position as a nerve center for entrepreneurship in Europe but also emerges as a model for the emerging digital economy. These developments promise a year of significant achievements and positive transformations for the Valencian Community.