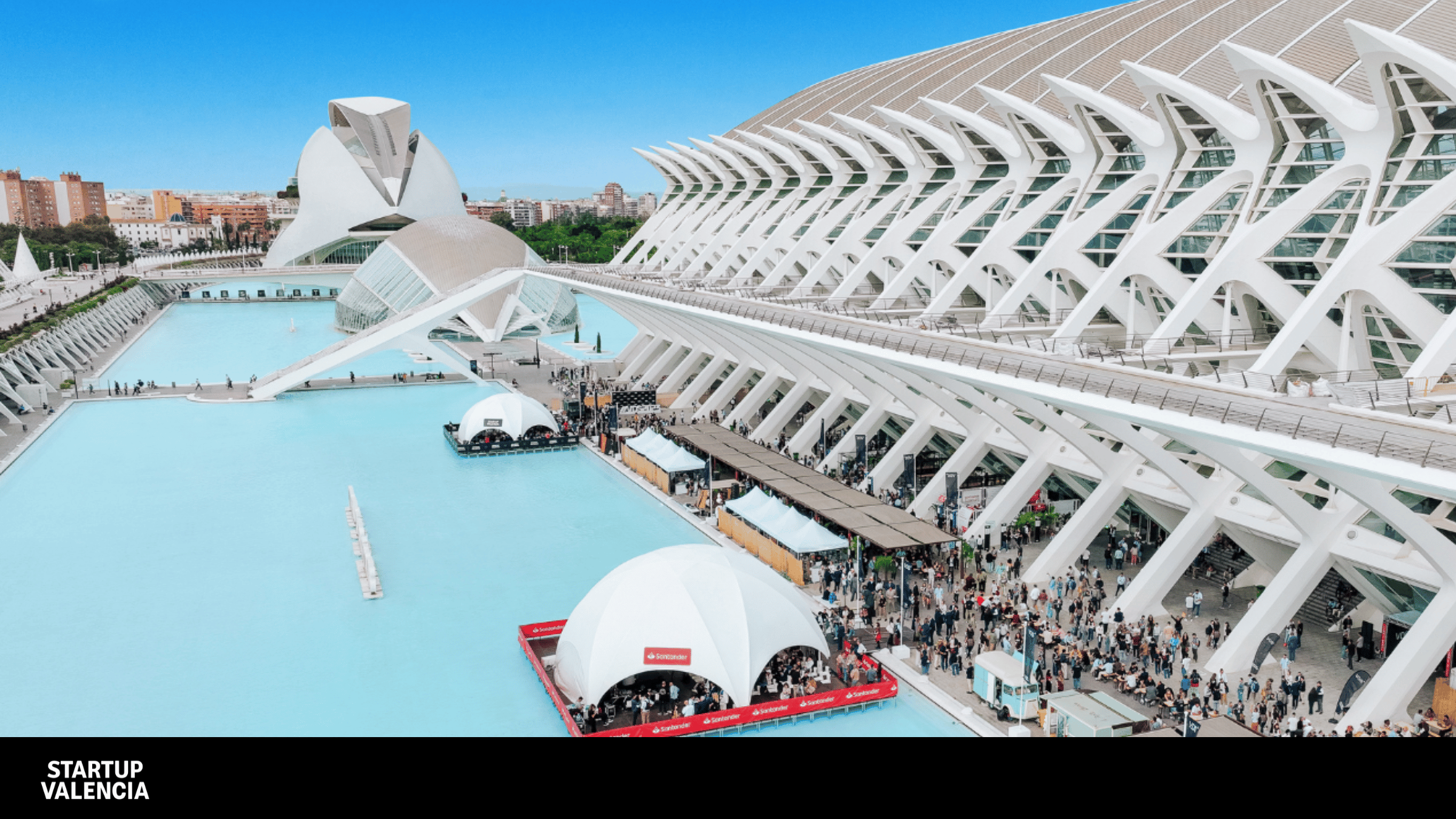

Valencia hosting an internationally prestigious event like VDS, a must-visit on the tech fair calendar for hundreds of startups, corporates, and investors, acts as a catalyst for the Valencian entrepreneurial ecosystem. Bringing together professionals from world-leading companies, major investment funds, and innovative businesses that transform entire markets creates an opportunity space for generating business and wealth.

The figures from the last edition, which brought together over 12,000 attendees from 91 different countries, more than 600 national and international investors managing assets worth over 30 billion euros, and more than 2,200 startups, breaking records for the second consecutive year, demonstrate this. Collectively, they had an economic impact of 12.3 million euros. For 2024, VDS will have strategic support from The Next Web (Financial Times) to accelerate its international expansion.

This is confirmed by the ‘VDS Impact Report’ prepared by consultancy EY alongside Startup Valencia. This detailed document also provides further data and useful conclusions for startups and corporates to understand trends in the entrepreneurial ecosystem, investor movements, booming sectors, etc.

Data and trends on startups and corporates from the VDS Report

Based on the study conducted by the mentioned consultancy, these are the main figures and conclusions of the Valencian entrepreneurial ecosystem, as well as general trends at the national and international level.

Startup competitions are an international showcase

Often, the return on participation and attendance at major tech events is associated with the capacity to generate business. Contacts made, follow-ups scheduled, meetings held, deals closed… However, startups must not overlook that these events are a unique opportunity to pitch to a global audience, showcasing their solutions to a diverse range of targets with the potential to increase their visibility and even win awards.

For example, in the last edition of VDS, there were 600 participants who applied to the startup competition. Among the 50 selected for the final phases of the ‘Growth’ and ‘Seed’ categories, 71% were from abroad.

Thus, as ‘ambassadors’ of the Valencian startup ecosystem, we must keep participation in similar contests on our radar. Take Uelz as a case in point, who won the fintech vertical competition at the last South Summit.

Attending tech events like VDS increases your investment opportunities

Products that solve real problems, a proven business model, users, and traction… the aspects that investors examine when deciding to invest in a startup vary widely. But it’s not all about metrics and data; the human factor represented by the founding team plays a crucial role in the decision-making process of funds and business angels. This was recently acknowledged by various fund representatives at the Investors Reverse Pitch by Startup Valencia, held at Banco Santander’s Work Café.

Thus, making personal connections and attending tech events like VDS where you can initiate and strengthen relationships with investors are other key elements in the fundraising process.

Since its first edition in 2018, startups that have participated in VDS have closed investment rounds worth 11.5 billion euros. And, from the consultations conducted with the 2023 participant startups, they aimed to achieve a total investment volume of over 50 million euros.

Artificial Intelligence and Sustainability as a counterbalance to the macroeconomic context

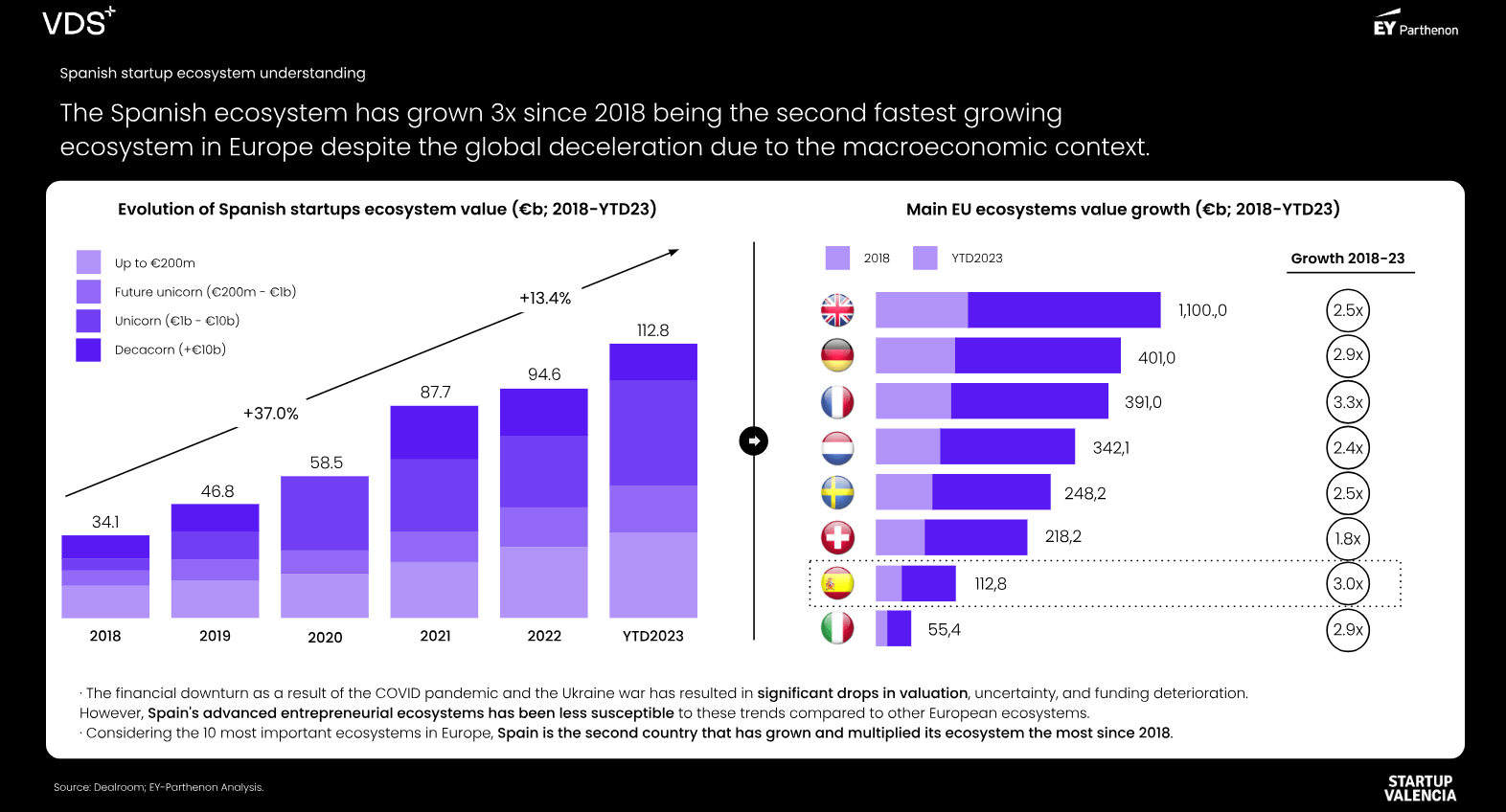

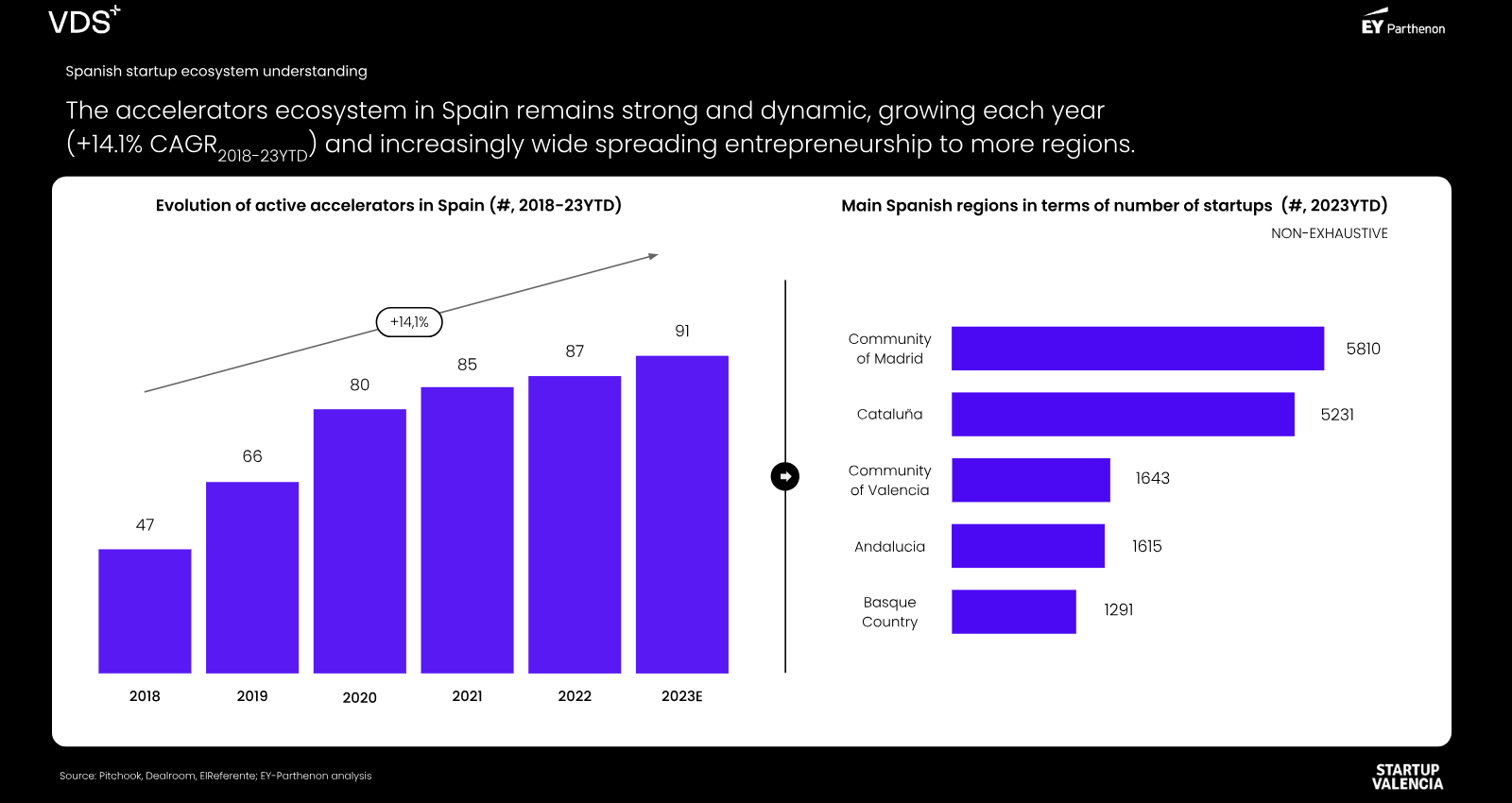

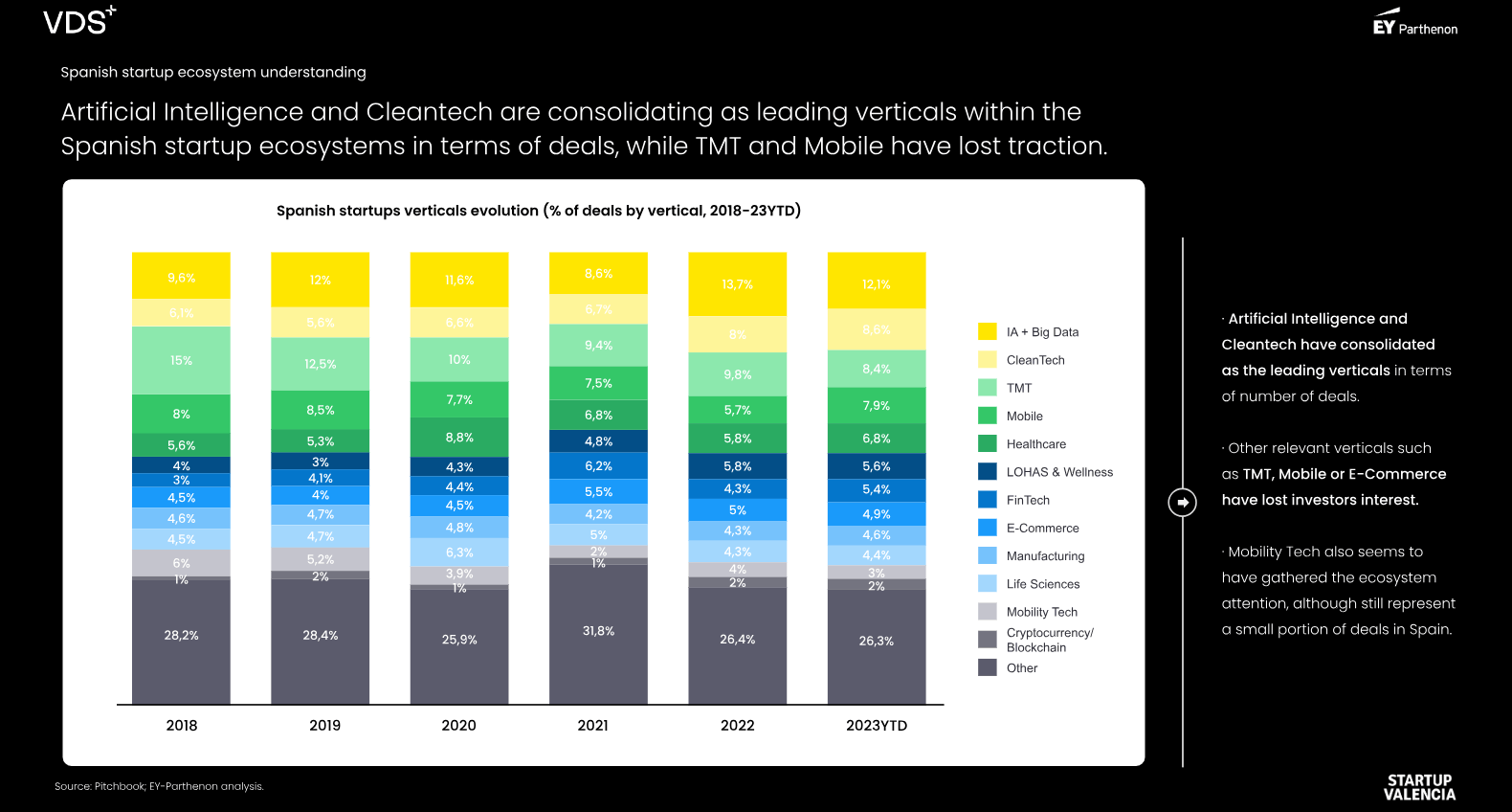

In Spain, the startup ecosystem continues to grow (x3 since 2018) and is the second fastest in Europe in terms of growth speed measured by investment achieved in 2023. At the same time, it experiences difficulties for mega-rounds due to the macroeconomic context and because it is still a ‘young’ ecosystem in the startup world.

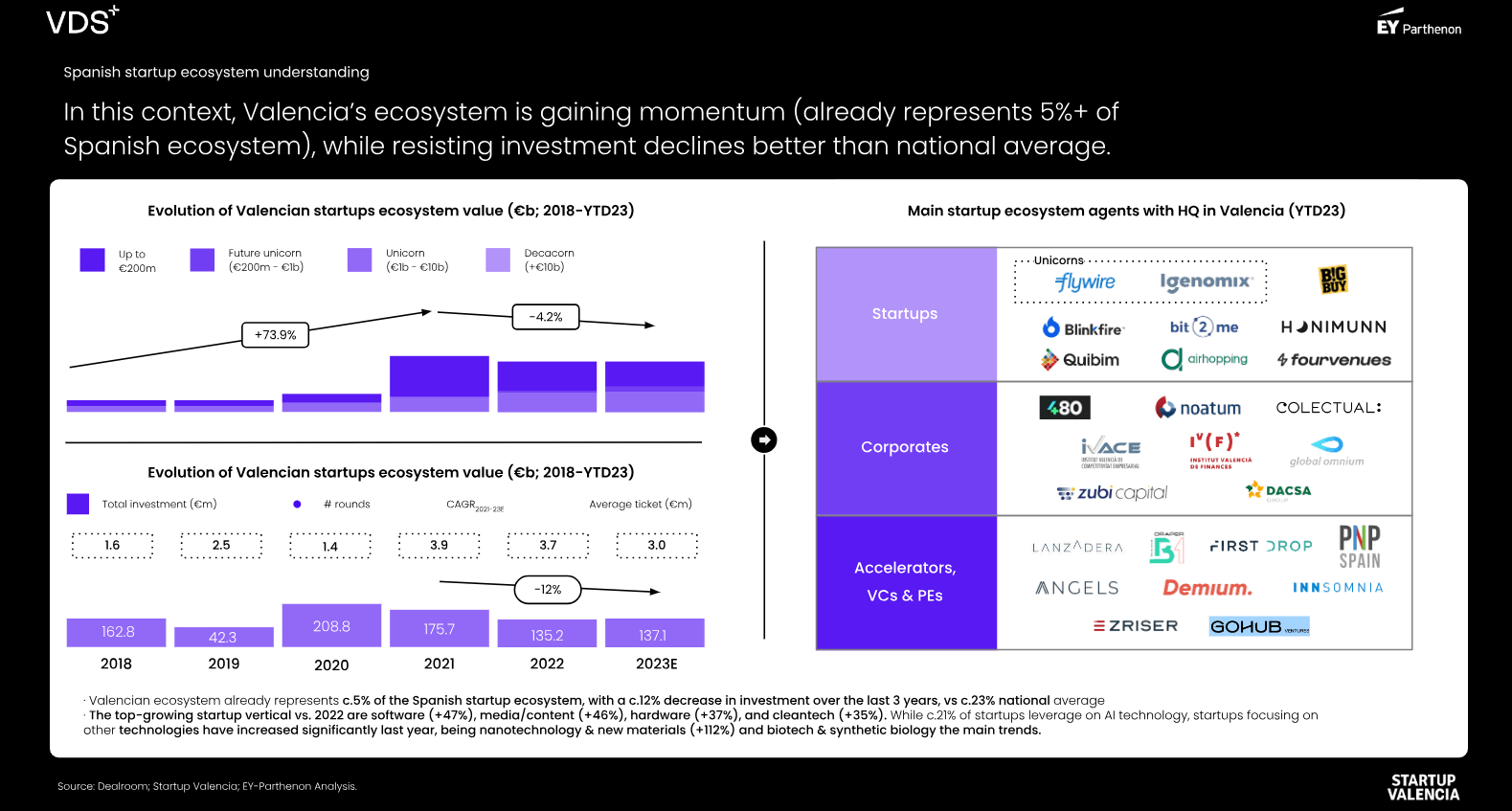

Locally, the Valencian entrepreneurial ecosystem represents more than 5% of the national scene and has resisted the slowdown in investment in 2023 better than other regions.

In a global economic environment of high interest rates affecting the capacity of investment funds to gather capital and channel it into new rounds towards startups, it can be stated that hot topic trends escape generalized analyses.

In the same year that Spain reduced its investment levels in startups by 34%, focusing solely on sectors like AI or Cleantech, we see spectacular growths of 305% and 71% respectively.

Being a startup that operates in these fields or having the ability to incorporate technologies and features that create competitive advantages through process optimization (AI) or reduce environmental impact can make the difference in securing investment or not.

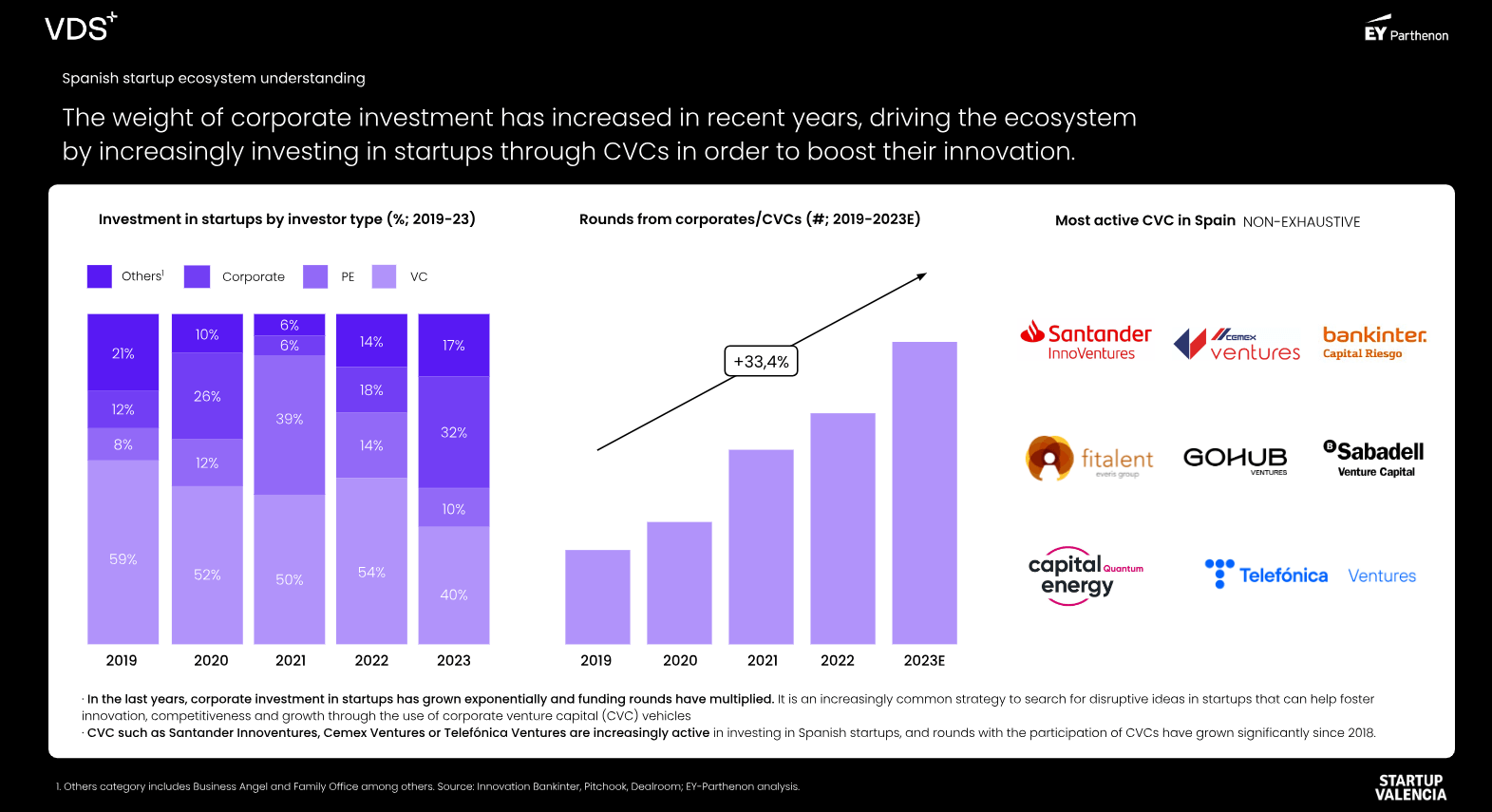

Corporate Capital Solidifies Its Place Among Investment Agents

Investment by corporate venture capital funds, known as CVCs, has now become a well-established reality within the array of investors that traditionally—in the startup world—was represented by Business Angels, specialized venture capital funds, and others (FFFs, entrepreneurs, or founders who invest or set up vehicles after achieving their initial successes).

Why is corporate increasingly investing? Large companies have realized that dedicating all their efforts to R&D is risky, even just from a balance and pure math perspective. Startups, previously viewed with a certain paternalism by corporations, are now seen as natural allies for implementing disruptive ideas, accelerating innovation, improving competitiveness, and facilitating greater growth.

Representative examples of CVC include Santander, Telefónica, Cemex, and the Valencian venture capital fund GoHub Ventures, a leader in B2B software startup investments.

Forecasts for the Valencian Entrepreneurial Ecosystem in the Short and Medium Term

Valencia is in an expansive phase of its entrepreneurial ecosystem. Having overcome the defensive stage caused by the health crisis and the paralysis it triggered in many sectors, and with inflationary shock on the decline, the outlook is promising for regions that have built a solid foundation over recent years, as is the case with the Valencian ecosystem.

The city has solidified its status as an international destination, not just for short stays, but as the best city in the world to live in. This appeal has led to the accumulation of talent in the ecosystem, bringing together a robust volume of expats who settle in our city with their skills and networks.

With the right business infrastructure and increasing access to investment as interest rates are anticipated to drop, this talent is activated and multiplies the productive capacity of the ecosystem.

This was demonstrated by the successful close of 2023, evidenced by the investment round of V2C (4 million euros) and the frenetic start of the year with BBVA Spark’s entry into Bit2Me (14 million euros) and the rounds for Internxt (3 million euros), Imperia (3 million euros), Depasify (2.2 million euros), Vidext (2.2 million euros), and Kokoro Kids (2 million euros), among others, which project figures close to a record investment for our ecosystem in a single year.

Given this, we identify the current phase of the economic cycle of Valencian startups as ‘expansive or booming,’ according to economic theory definitions.

An optimistic outlook that encourages all stakeholders to continue striving to scale our ecosystem.