There has never been as much money on the table to invest in startups as there is now and as there will be, presumably, in the coming years. Taking a look at the most recent figures from just before the summer, 2021 is set to be a record year in terms of the number of operations, the total investment volume, and the size of the rounds. And the startup sphere just keeps thriving; take, for example, the 67 million euros raised by Factorial this September to boost its business abroad.

At the same time, there have never been so many entrepreneurs devoted to turning their ideas into businesses. Whether it’s their tenacity to ‘change the world’, their inspiration from other success stories, the foundations of a mature ecosystem, or the fact that life is simply too short to be dull: more and more of them are taking the plunge.

In this context of capital in search of returns and entrepreneurs in search of investment, the Investor Deck is one of the key elements to arouse the interest of investors. If we also take into account that, in most cases, it’s very likely that venture capital analysts and business angels will review this document for the first time without the presence and explanations of the founders, knowing how to create a self-explanatory Investor Deck that captures the attention of investors is fundamental for the startup’s future.

Investor Deck step by step. How to arouse investor interest in your startup

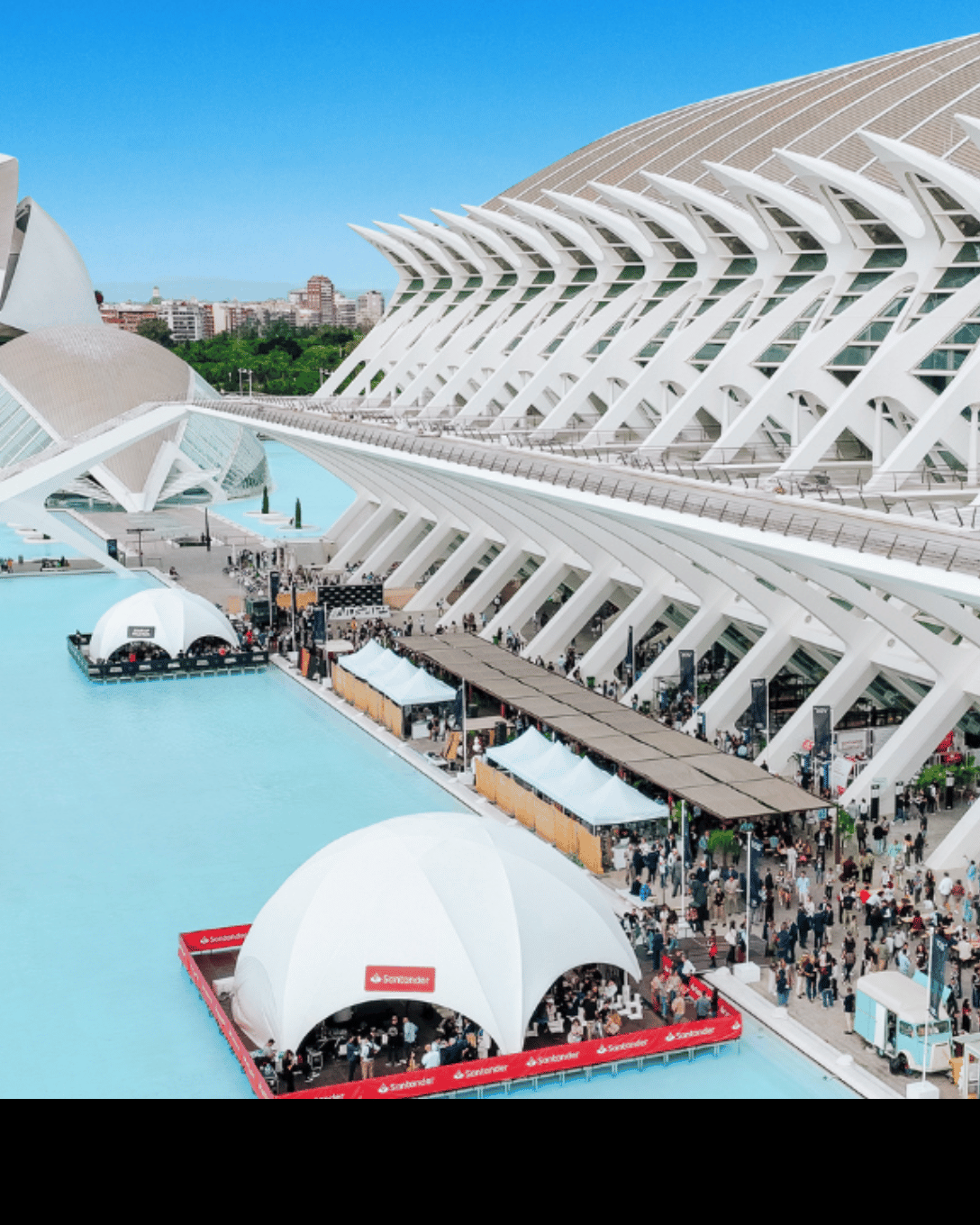

The volume of entrepreneurs seeking investment for their projects is so immense that filtering programmes are even used to ensure that investors receive qualified deal flow. This is, for example, the case of Capital4Startups.org, the Startup Valencia initiative to opt for in the investment process of a selection of funds and family offices.

Once that first filter has been overcome, a step which can often be done online, it is time for analysts to review the Investor Deck. This presentation serves to introduce the problem, set forth the solution, point out the competitive advantages, measure the size of the market, explain how money is to be made, identify the team that will carry out the mission, and quantify the size of the investment round being sought and at what valuation.

We can establish the following format for a standard Investor Deck:

- Front page

- The Problem

- The Solution

- Market (+ Competition)

- Business Model

- Team

- Investment

Of course, there are other variables that can be added to the Investor Deck and that depend on the phase of the project (idea, early stage with demo, scale-up, etc). These could integrate other sections to the above table of contents, for example:

- Metrics (in case there is a product already working on the market)

- Roadmap (next steps to be taken in product and strategy)

Golden rules and detailed guide to make a self-explanatory Investor Deck

Before going through the different sections that we recommend your Investor Deck have one by one, here are a number of suggestions to keep in mind:

- Use English as the language of your Investor Deck. It doesn’t matter if you are starting in Spain or if you don’t have a clear expansion strategy, you must show investors that you have ambitions to conquer a wider market.

- Follow the maxim ‘less is more’. Try to reduce most of the sections from the table of contents to a single slide, meaning your Investor Deck should end up being around 10 slides long. Also, increasing the font size to 30 points won’t give you slides with too much text and will force you to synthesise (English is the best language for this). If you have to present it, make it no longer than 20 minutes. This is Guy Kawasaki’s 10/20/30 method.

- Use a standard format (.pdf) for the file and avoid the recipient having to download it from the cloud. Instead, leave it attached to the email or form that you have to fill in.

- Find examples of Investor Decks and ask other trusted entrepreneurs about yours before sharing it.

It’s time to get to work. The moment has come to build your Investor Deck and to do so we will follow the aforementioned format:

Front page

Embrace minimalism. The only thing you need on this slide is:

- Logo

- Startup Name

- Mission. We aren’t talking about Nike’s ‘Just Do It’, but about the ‘What’. Here are some examples:

- Flywire: Delivering the most important & complex payments.

- Bounsel: All-in-one cloud solution to work with contracts.

- Yeeply: Hire the most relevant agencies for your project.

- Camillion: Smart messaging for remote teams & professionals.

- Quibim: The full-body medical imaging ecosystem that understands every body part.

- Date (make sure you keep your Investor Deck up to date)

The Problem

The ‘why’ is one of the most powerful aspects of your Investor Deck, especially since it’s presented early on in the presentation and therefore at a moment in which the reader is paying the most attention.

It seeks to make an impact by presenting a problem that is painful enough for those who suffer from it but also important enough for it to be worth solving.

The Solution

Introduce your solution to the identified problem and how it differs from existing solutions on the market.

Don’t overdo it by exaggerating your solution or pointing out its many potential qualities. Stick to that one attribute that makes it different.

Market

Once again, ‘less is more’. It’s not about listing numbers and statistics, but about quantifying the overall market size (Total Addressable Market), the market size you are currently able to address (Serviceable Available Market), and the market size you hope to achieve (Serviceable Obtainable Market). Follow these tips to calculate your project’s TAM, SAM and SOM.

If you consider them to be ‘small’ volumes, you can also add the market growth figure to anticipate the evolution of the sector and show the investors that the pie is only getting larger.

Business model

Explain how you are going to make money. In the AirBnb Investor Deck that we linked earlier it’s very clear: ‘we take a 10% commission on each transaction’.

In addition to explaining your business model, make a revenue estimate based on the previous market data.

You can extend this slide to introduce the competition. If you do so, don’t minimise their strengths or weaknesses, try to be as neutral as possible and point out the differences that exist with your product or business model.

Team

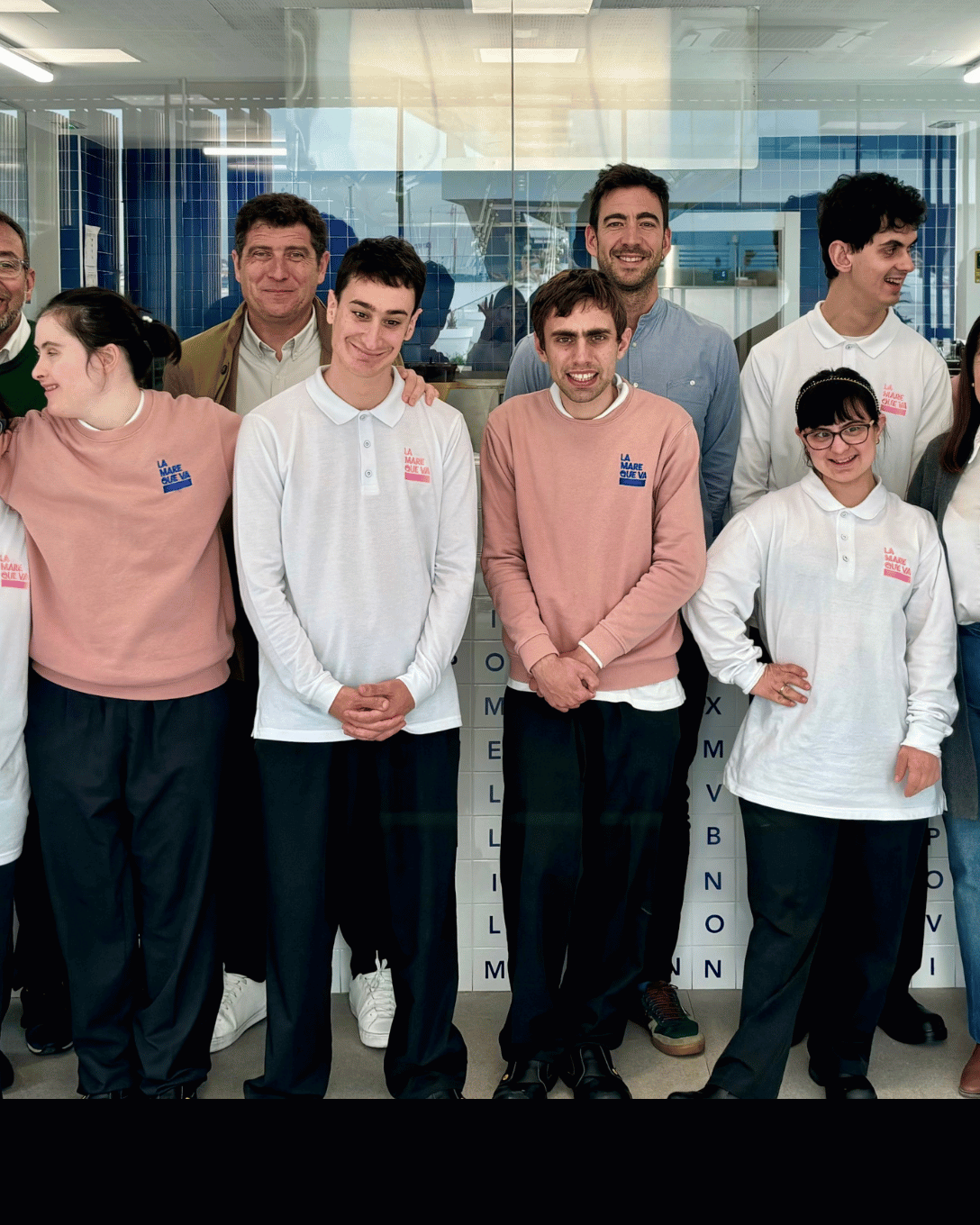

Surprising as it may seem, the main element when investing in a startup is the people behind it.

So, in addition to naming and mentioning the position of the founders, we recommend you include possible past work or entrepreneurial experience (‘ex_Name_Company’) as well as academic experience (‘Alumni_Name_School_or_University’) in this slide. It may be very useful if investors want to ask for references from someone in their network.

Investment

How much money you are looking for and what you plan to invest it in. If you already have previous or committed investors that you can point out, it’s also good to mention them in order to build trust with the new ones.

Regarding the valuation, this is something that you can reveal once you have aroused investor interest and you have to negotiate their entry into the company.

Final tips on how to make an Investor Deck that brings you closer to investors

- Don’t forget to leave your contact information (at least your phone number and email address). You can include them in the closing slide.

- Don’t give too many details in any of the parts (product, metrics, financing, team, etc.); it’s better to leave some uncertainty so the investor will want to follow up.

- Take good care of the visual appearance and design of your Investor Deck. If not done by a professional designer, make sure you at least use professional templates and high-quality images.

- Monitor the mailing if you can so you can follow up more effectively by understanding if the recipient has opened the email and viewed the attached file.

- If you aren’t engaging investors, try to understand why. For example, your metrics may still be low (meaning you can try again later) or the investors may be looking for larger rounds (you can keep them on your radar for a future series).

Now you are ready to surprise investors. As a final piece of advice, check the social network accounts of the funds and business angels that you plan on ‘attacking’, along with their blogs, as they usually provide information on the sectors in which they are most active and what factors they particularly value when it comes to investing: very valuable information to wrap up your Investor Deck.

About Capital4Startups.org

Capital4Startups.org is a Startup Valencia initiative that facilitates access to investment at a time when speed and agility are the key to growing your entrepreneurial project.

Participate here by filling out a single form for your startup to access the investment process of the following selection of 42 funds and family offices: Angela Impact Economy, Antai, Bewater Funds, Banco Sabadell’s BStartup, GoHub, Grupo Zriser, R2 Seed Investments, Ship2B, Samaipata, Seaya, Columbus Venture Partners, BIGBAN, Creas, Aldea, NewTech Capital, Austral, Innoventures Capital, Zubi Labs, Fondo Bolsa Social, Startupxplore, Athos Capital, All Iron, ACCIONA, Elewit, Kibo, Swanlaab, Think Bigger Capital, Hello World, Sabadell Venture Capital, Conexo, Clave, October, Draper B1, Inveready and Keiretsu.