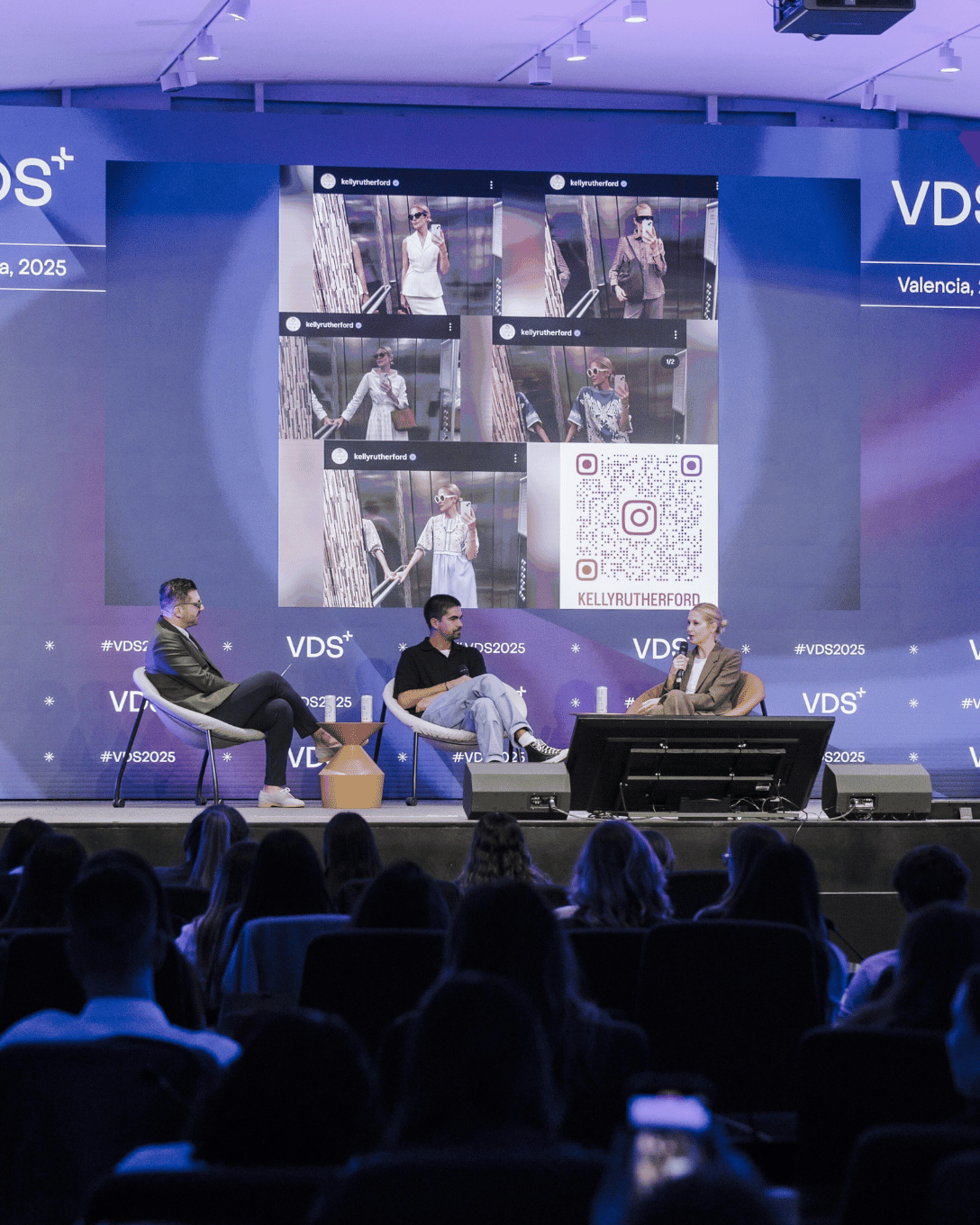

Valencia startup investment has reached a new milestone in 2025, exceeding €200 million thanks to a series of recent funding rounds. The figures confirm the resilience of the tech ecosystem at a time when venture capital activity across Europe is showing signs of recovery after a challenging 2023 and 2024.

Breakthrough Round Puts Biotech in the Spotlight

The surge in investment has been driven by several standout operations. In early September, the Observatorio de Startups de la Fundación Bankinter reported that companies in the region had already secured €161 million across 24 rounds, with an average of €7 million per deal.

That momentum was reinforced when Arthex Biotech, a biotechnology company headquartered in Valencia, announced the closing of a $45 million (€42 million) round led by Bpifrance.

Arthex Biotech is developing RNA-based therapies for rare genetic disorders, with its leading program targeting myotonic dystrophy type 1, a debilitating neuromuscular disease for which no cure currently exists. The new capital will allow the company to advance its clinical trials and strengthen collaborations in Europe and North America.

The participation of Bpifrance, France’s public investment bank, underlines international confidence in Valencia’s life sciences sector and shows the capacity of local biotech ventures to compete globally.

From Medical Imaging to Cloud Storage

Other significant rounds this year reflect the diversity of the ecosystem. Quibim, a pioneer in biomedical imaging diagnostics, raised €47.6 million to expand internationally and bring its AI-driven radiology platform to more hospitals and research institutions.

Maisa AI, another Valencia-based startup, secured €21.4 million, while Bit2Me, based in Alicante and a leading provider of cryptocurrency services, closed a €30 million round that strengthens the region’s growing fintech and insurtech sector.

Smaller but strategically important rounds have also added momentum. Voxelcare, an Elche-based company specializing in health technology, attracted €5.5 million to accelerate its development of biomechanical solutions. Internxt, a Valencia-born startup focused on decentralized and privacy-driven cloud storage, raised €3.3 million to expand operations across Europe and Latin America. Fourvenues, the software platform serving the nightlife and events industry, also secured new funding to scale its services to international markets.

Together, the Valencia startup investment of these rounds bring the year’s total to more than €200 million, underscoring the breadth of activity across sectors and confirming Valencia’s ability to deliver companies that attract capital at every stage of growth.

Valencia Consolidates Its Place as Spain’s Third Innovation Hub

The variety of these operations illustrates the strength of Valencia’s startup community. From biotechnology and digital health to fintech and SaaS, the region is producing a new generation of companies capable of competing internationally.

More than 1,200 startups are active in the region, placing Valencia firmly in third place among Spanish hubs, behind only Madrid and Barcelona. The Valencia startup investment builds on a trajectory that has seen sharp swings over the past seven years —from €128 million in 2018 to just €28.8 million in 2019, then a record €186 million during the pandemic year of 2020.

After fluctuations in 2021–2024, the €200 million milestone in 2025 signals that the ecosystem has regained an upward path.

Spain as a whole has already attracted nearly €2 billion in startup investment this year. Madrid continues to dominate in fintech, logistics and enterprise software, while Barcelona leads in biotech, gaming and mobility. Against this backdrop, Valencia’s performance demonstrates that investment is no longer concentrated exclusively in the country’s two largest cities.

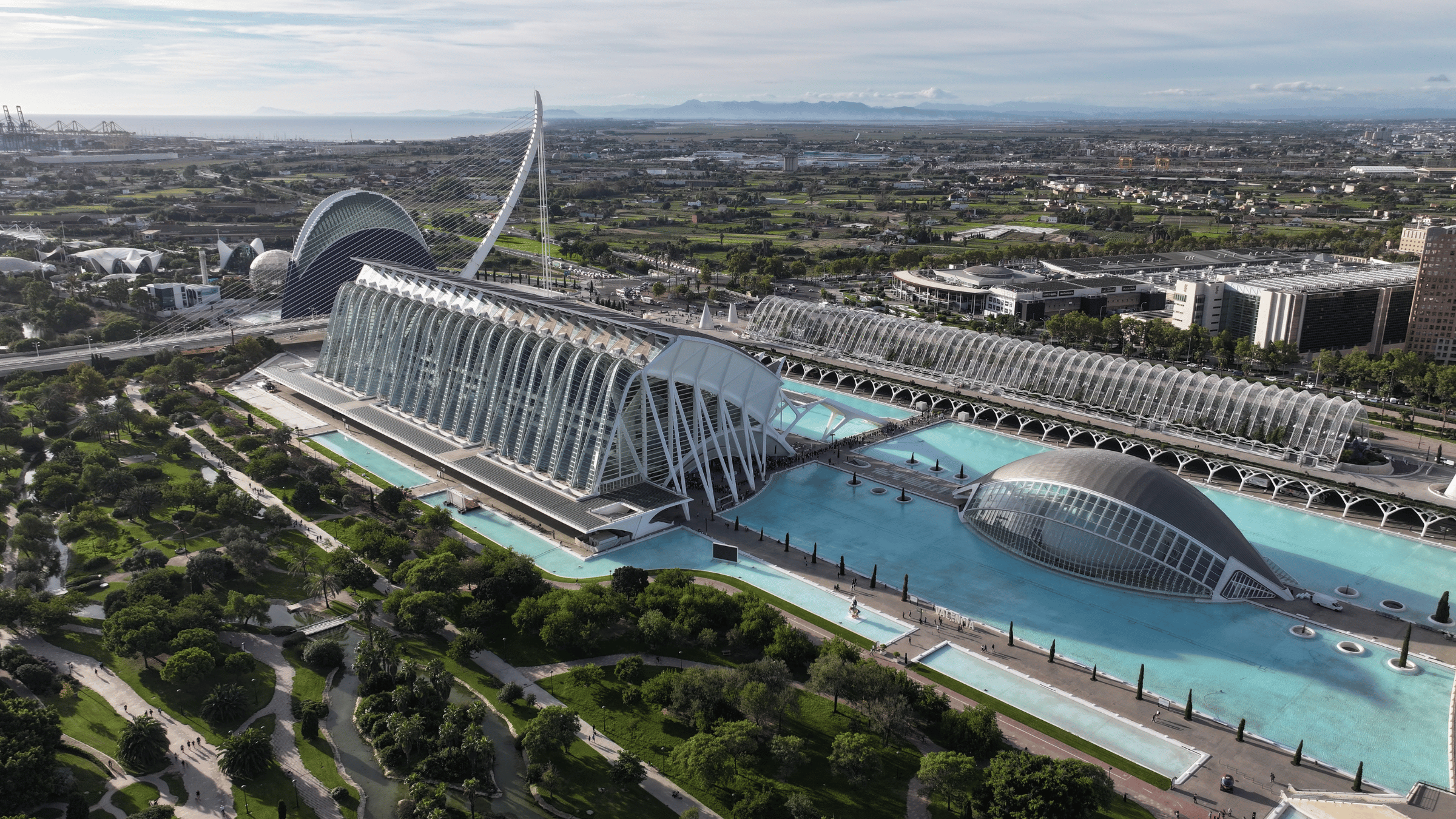

The city is increasingly recognized as a third pole of innovation, with growth rates that position it alongside medium-sized European hubs such as Marseille, Bologna or Munich.

Foreign Investors Take Notice

Another defining feature of 2025 has been the arrival of more international capital. The leadership of Bpifrance in Arthex Biotech’s round is one example, but other global funds have also participated in Valencian deals this year.

Their presence brings not only fresh capital but also access to networks, expertise and new markets. Combined with Valencia’s advantages, a strong university and research system, lower operating costs compared with larger cities, and high quality of life, the international interest suggests the region is well placed to continue attracting world-class investors.

Beyond a Milestone: Building Long-Term Momentum

Crossing the €200 million threshold is more than a symbolic achievement. It signals a turning point in the maturity of the Valencian ecosystem and its ability to deliver high-impact companies across multiple sectors.

The coming months will be decisive in determining whether this momentum can be consolidated. Continued progress will depend on helping startups scale internationally, strengthening sector clusters in biotech, health tech and fintech, and ensuring that the city remains visible on the European investment map.

What is clear is that Valencia has moved beyond the stage of being an emerging player. With more than €200 million raised in 2025, the city is consolidating its status as a leading innovation hub, one capable of competing with Europe’s mid-sized centers and proving that entrepreneurial talent can flourish well beyond Spain’s two largest metropolitan areas.